As information of tariffs that can increase automotive costs unfold, People got down to purchase the vehicles nonetheless on seller tons at pre-tariff costs in March. New automotive costs held comparatively regular in the course of the month, however the nationwide stock of latest vehicles declined considerably.

The common purchaser paid $47,962 in March – little modified from February’s $48,039 common value. The anticipated value will increase have largely held off within the early days of the tariffs.

Provide Shrinking

That’s true principally as a result of automakers have already got a provide of latest vehicles within the nation at pre-tariff costs. All through 2024, many had a major oversupply. March’s gross sales tempo noticed stock shrink dramatically.

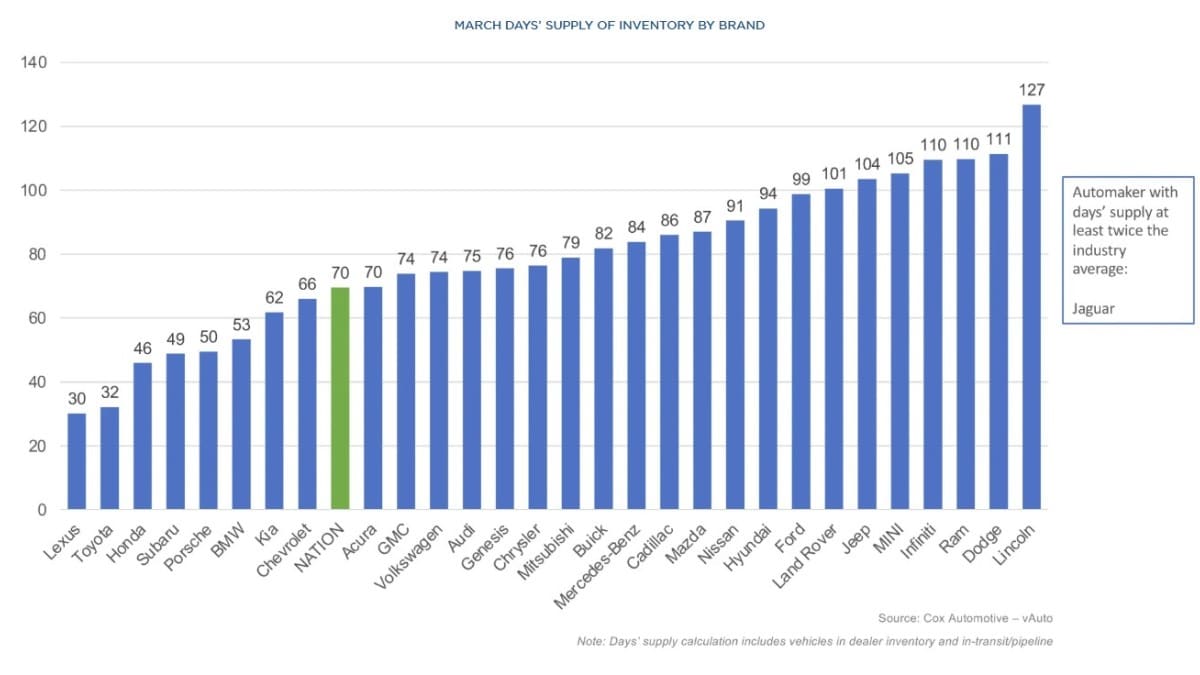

An outdated business rule of thumb tells sellers to maintain a few 75-day provide of latest vehicles, together with 60 days’ price on the lot and one other 15 in transit.

The common seller entered March with an 89-day provide. They ended it with 70.

That common is made up of outliers. Toyota and its Lexus luxurious model sit on the low finish of the dimensions, with simply 32 and 30 days’ price, respectively. They’re significantly quick on standard hybrid fashions. Lincoln and Dodge maintain down the opposite, with 127 days and 111 days.

Amongst mainstream automakers, 10 manufacturers noticed their provide fall by 30 days or extra in the course of the month. Lincoln led all with a 54-day lower.

Incentives Principally Unchanged

The tariffs precipitated automakers to alter their promoting, with each Ford and Stellantis (guardian firm of Chrysler, Dodge, Jeep, Ram, and others) introducing new “worker pricing” offers. However the change, to this point, is only a matter of promoting.

Incentives – the reductions automakers and sellers promote to lure consumers – stayed almost flat between February and March. They made up 7% of the typical sale, down simply 0.2% month-over-month and up simply 0.3% year-over-year. The common sale included $3,339 price of incentives.

Worth Stability Not More likely to Final

As sellers promote down their pre-tariff stock, they’ll have to usher in replacements at post-tariff costs. Which means value will increase will begin to present. Stock may begin to resemble 2021 circumstances when COVID-19-related shutdowns and provide chain issues precipitated automakers to construct fewer vehicles.

However, in the course of the COVID disaster, some American households had extra to spend. Federal authorities reduction applications despatched checks to most American adults, giving some further spending energy.

Tariffs will possible lower People’ spending energy as the costs of many items rise with no authorities reduction to offset the spikes.

Cox Automotive Govt Analyst Erin Keating explains, “How excessive costs rise for customers continues to be very a lot to be decided, as every automaker will deal with the value puzzle otherwise. Ought to the White Home posture maintain, our crew is anticipating new autos straight impacted by the 25% tariff to see value will increase within the vary of 10-15%.”

She provides, “Contemplating the market dynamics, we additionally anticipate seeing a minimum of a 5% improve in costs of autos not subjected to the complete 25% tariff. There is no such thing as a manner round it: Tariffs are going to push new-vehicle costs larger within the U.S.”

Cox Automotive owns Kelley Blue E-book.