MANILA, Philippines – Expectations that the Bangko Sentral ng Pilipinas (BSP) might slash its coverage rate of interest once more in June energized buyers on Tuesday, with the index closing slightly below the 6,200 barrier.

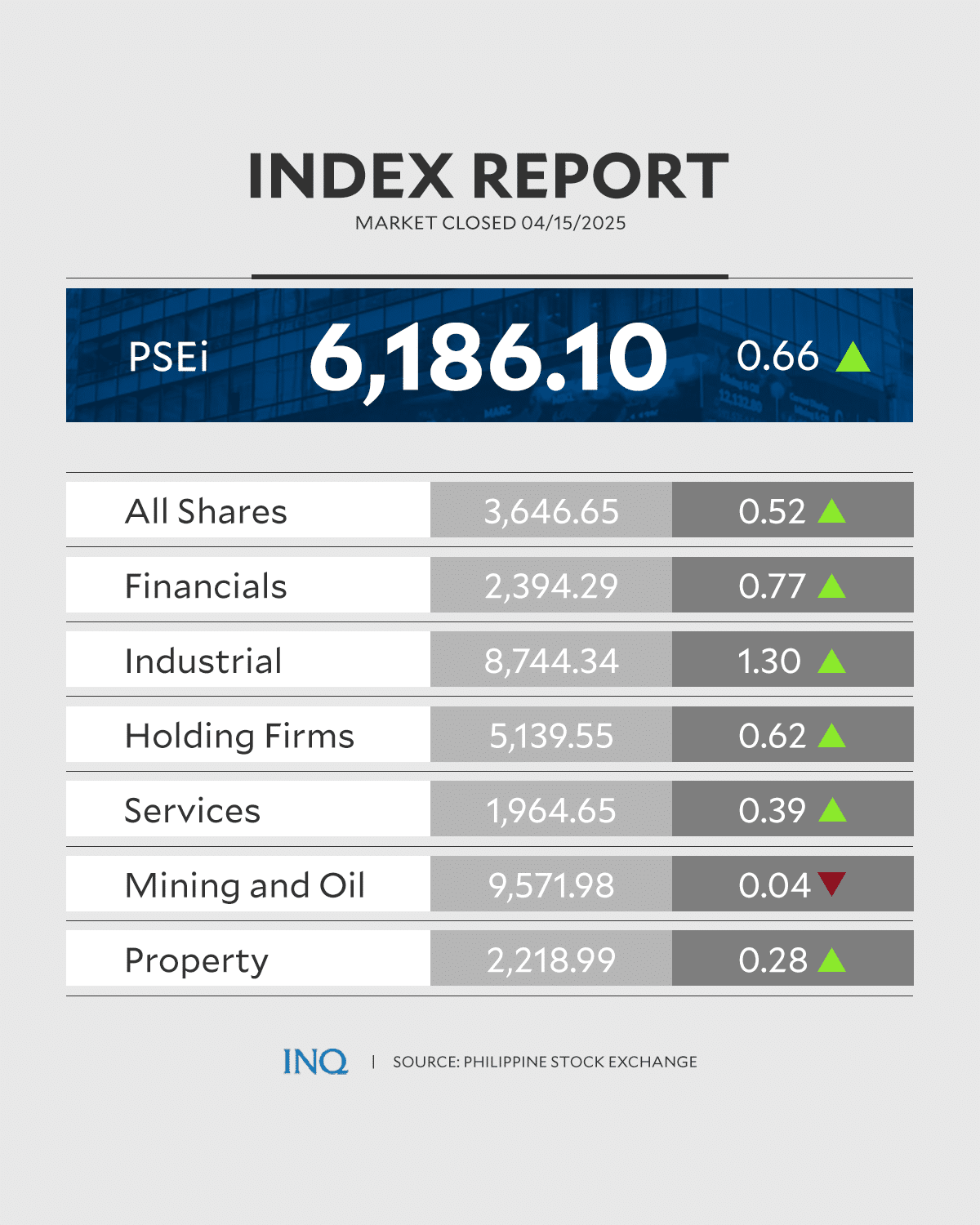

The benchmark Philippine Inventory Trade Index (PSEi) added 0.66 p.c, or 40.58 factors, to shut at 6,186.10.

Likewise, the broader All Shares Index climbed by 0.52 p.c, or 18.76 factors, to three,646.65.

READ: Extra BSP price cuts on the desk to spur progress

A complete of 1.4 billion shares price P4.46 billion modified fingers, inventory alternate knowledge confirmed.

The native inventory barometer rose due primarily to expectations that the BSP would once more lower the benchmark price for in a single day borrowing throughout its subsequent rate-setting assembly, stated Luis Limlingan, head of gross sales at inventory brokerage home Regina Capital Improvement Corp.

On the similar time, merchants additionally cheered US President Donald Trump’s transfer to exempt smartphones, computer systems and semiconductor chips from his “Liberation Day” tariffs, Limlingan famous.

The commercial sub-sector registered the steepest acquire, together with banks.

Worldwide Container Terminal Companies Inc. was the top-traded inventory because it shed 0.17 p.c to shut at P354 every.

It was adopted by BDO Unibank Inc., up 1.39 p.c to P160; Ayala Land Inc., up 0.63 p.c to P23.95; SM Prime Holdings Inc., down 0.44 p.c to P22.65; and Jollibee Meals Corp., up 4.72 p.c to P230.60 every.

Different actively traded shares had been: Converge ICT Options Inc., up 4.11 p.c to P18.74; SM Investments Corp., up 1.78 p.c to P829.50; Bloomberry Resorts Corp., down 1.69 p.c to P2.90; Manila Electrical Co., up 3.21 p.c to P578; and Financial institution of the Philippine Islands, up 0.69 p.c to P132 per share.

Gainers edged out losers, 102 to 79, whereas 66 firms closed flat, inventory alternate knowledge additionally confirmed.