Annual shareholder conferences for established public corporations are normally fairly sedate affairs. Attorneys and executives interact in cautious preparation, satisfying authorized necessities, however except the agency is below activist investor siege or is circling the drain financially, the yearly assembly comes and goes with little fanfare. Until, after all, we’re coping with Tesla.

Tesla’s market cap has slipped under $1 trillion, however it’s nonetheless among the many world’s most precious corporations. So it was bizarre and suspicious that Tesla hadn’t set a date for its annual assembly, which in response to Texas legislation was alleged to occur 13 months after the 2024 gathering: no later than July 13, as The New York Occasions reported. (Tesla included in Texas in 2024 after having beforehand been included in Delaware.)

Following some shareholder agitation reported by Reuters and the media noticing that Tesla was going to be late, the firm advised regulators yesterday that it could maintain the assembly … on November 6. November 6! A four-month delay that is going to lift all method of questions on what the heck is happening with Elon Musk’s empire.

So what is going on on with Tesla?

There are two elements to contemplate right here. First, Tesla will in all probability report its third-quarter earnings across the finish of October, so the corporate needs a while to enhance its enterprise efficiency after a gross sales decline and stock-price slide earlier than it faces shareholders. Improved outcomes may quell anger and provides Musk a while to meaningfully re-engage with, you recognize, working Tesla as CEO slightly than beginning a brand new political get together, canoodling with the far-right in Germany, or teasing his data of the Epstein information.

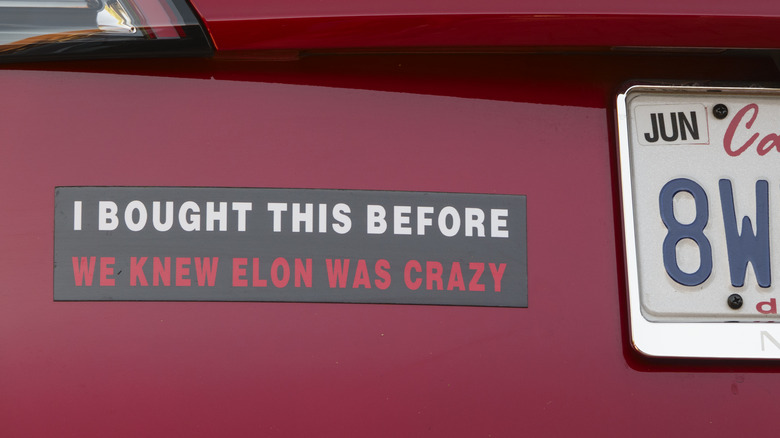

Second, Tesla needs to stall any potential shareholder agitation concerning Musk and his actions and compensation, alongside an effort to displace Tesla board members, who’ve been extensively criticized for letting Musk do no matter he needs and permitting Tesla’s worth to say no. Clearly, it has been a complete new world for Tesla traders since final 12 months, earlier than Musk threw himself into electing Donald Trump after which overseeing DOGE and its helter-skelter assault on the federal paperwork.

It is unlikely that Texas would have achieved something if Tesla continued to blow off its annual assembly. Musk’s entire motive for re-incorporating within the Lone Star state was to flee the upper degree of authorized scrutiny that Tesla was going through in Delaware, the place a decide had shot down his bonkers pay package deal. On the time, he mentioned Texas and Nevada have been states that empowered shareholders, not courts, to make choices. However a 12 months later Tesla now appears to suppose that shareholders making choices is likely to be an issue.

Is Tesla the primary huge American company that simply does not give a crap?

A scenario like this may usually get the SEC’s consideration, however the challenge for Tesla is not monetary: when the firm experiences Q2 outcomes on July 23, Wall Road is not anticipating nice issues resulting from lowered deliveries, however analysts additionally do not suppose the inventory goes to utterly tank.

Fairly, Tesla is staring down a critical governance problem. Prior to now, complaints about Musk and the board normally died as a result of shareholders have been getting reliably richer. However now the massive pension funds with Tesla publicity and clearcut fiduciary obligations have extra to reply for.

As effectively they need to. Tesla shares have slid 25 % since a rally following the election, and one may say with a smirk that Musk barely presided over the dip, because the absentee CEO was sleeping on flooring in Washington and eating at Mar-a-Lago when he wasn’t bickering with cupboard secretaries. He seems tired of the automobile enterprise and has recast Tesla as an autonomous mobility, robotics, and AI firm — all applied sciences which are at present producing negligible income. Musk and the Tesla board do not wish to reply to anyone proper now, and this absurd delay on the annual assembly is a wager that almost all traders will not in the end care. However it’s additionally a dangerous wager that come November, at present ticked-off traders may have much less to complain about.